.png)

It may seem incredible to submit a credit request and know that you will unconditionally qualify for a payday loan, but is it possible? Many internet lenders now advertise quick and simple processing, but things might be more complicated than in theory.

Cash advances with no denial are advertised as having no strict requirements. Therefore, in most circumstances, you won't have to present many documents to get quick financing. However, if you study such websites offering no denial loans, you'll notice that this isn't exactly accurate since your request may be turned down. Consequently, no-denial loans don't really exist since there are many reasons why you might not get credit. For example, being unemployed, having a poor credit score, or earning a modest monthly salary are some of the most common reasons you may not get rejected for quick financing. In addition, payday funding is not available in every state; thus, you always need to check your local regulations before shopping around for a no denial payday advance online.

Risks Associated with No Denial Advances Online

Debt Cycle

When your financial resources are nearly drained, payday advances may provide temporary relief. However, in the end, you are only sticking yourself further into debt. According to the Consumer Financial Protection Bureau (CFPB), almost 75% of payday loans are issued to those who take out a dozen or more loans in a year. Many Americans are unable to repay their payday debt when it's due, so they choose to refinance it into a new one, creating a debt cycle.

Predatory Fees

The average annual percentage rate (APR) for credit cards is between 12% and 30%. According to the CFPB, on average, a payday tool may include a cost of $15 for every $100 borrowed, resulting in an APR of over 400 percent. In practice, a $500 cash advance may cost you $50 in finance charges. And if you keep extending your debt, you can wind up repaying as much in costs as you initially borrowed.

Rollovers Stimulate to Accumulate More Debt

When payday financing is due and you cannot pay the entire balance, some lenders may enable you to simply pay the initial cost to postpone the due date. However, a charge of the same amount is then added to the principal. If you took out $400 and were charged a cost of $15 for each hundred borrowed, you would owe $460 upon your next paycheck. If you pay the $60 cost to extend the payment date, the lender may add another $60 fee on top of that, and so on.

Calls from Collection Agencies

Due to the high cost of no denial payday loans online, you may not be capable of paying your debt on time, resulting in frequent calls from debt collection agencies. According to the Fair Debt Collection Practices Act, a debt collector is not authorized to contact you frequently with the purpose of annoying, abusing, or harassing you. Debt collectors are only allowed to phone between 8 a.m. and 9 p.m.

Payday Tools Don't Cover Big Price Tag Expenses!

Payday lenders are normally restricted to $1500, depending on the local regulation. As a result, don't anticipate this sort of financing that may help you get out of debt or cover major needs like the home renovation or debt consolidation.

Alternatives to No Denial Loans

Overdraft

A scheduled or authorized overdraft on your checking account indicates that your bank has agreed to lend you a specific amount in advance. Depending on the lender, APRs on overdrafts may run from 15 percent to 40 percent (the FCA outlawed daily and monthly charges in April 2020). Thanks to the same FCA regulations, lenders may no longer charge more for unarranged overdrafts than for permitted ones. If you go over-drafting without permission, it can hurt your credit score, and if there isn't enough money in your account, your bank will typically reject payments made by direct debit or check.

Cash Advances

It's a costly method to borrow because you'll often be charged a fee as well as interest from the time you make the cash withdrawal. On average, the interest on a credit card varies between 23 to 25 percent per annum. In addition, cash advances might also serve as a red flag to lenders that you aren't good with money. As a result, having these concerns on your file may make it more difficult to obtain future loans at reasonable rates.

A Personal Loan

These tools allow you to borrow a big sum of money for a specific period and repay it in equated monthly installments (EMI). A personal loan is a less expensive type of financing. On the other hand, unsecured debt will almost always require a good credit history.

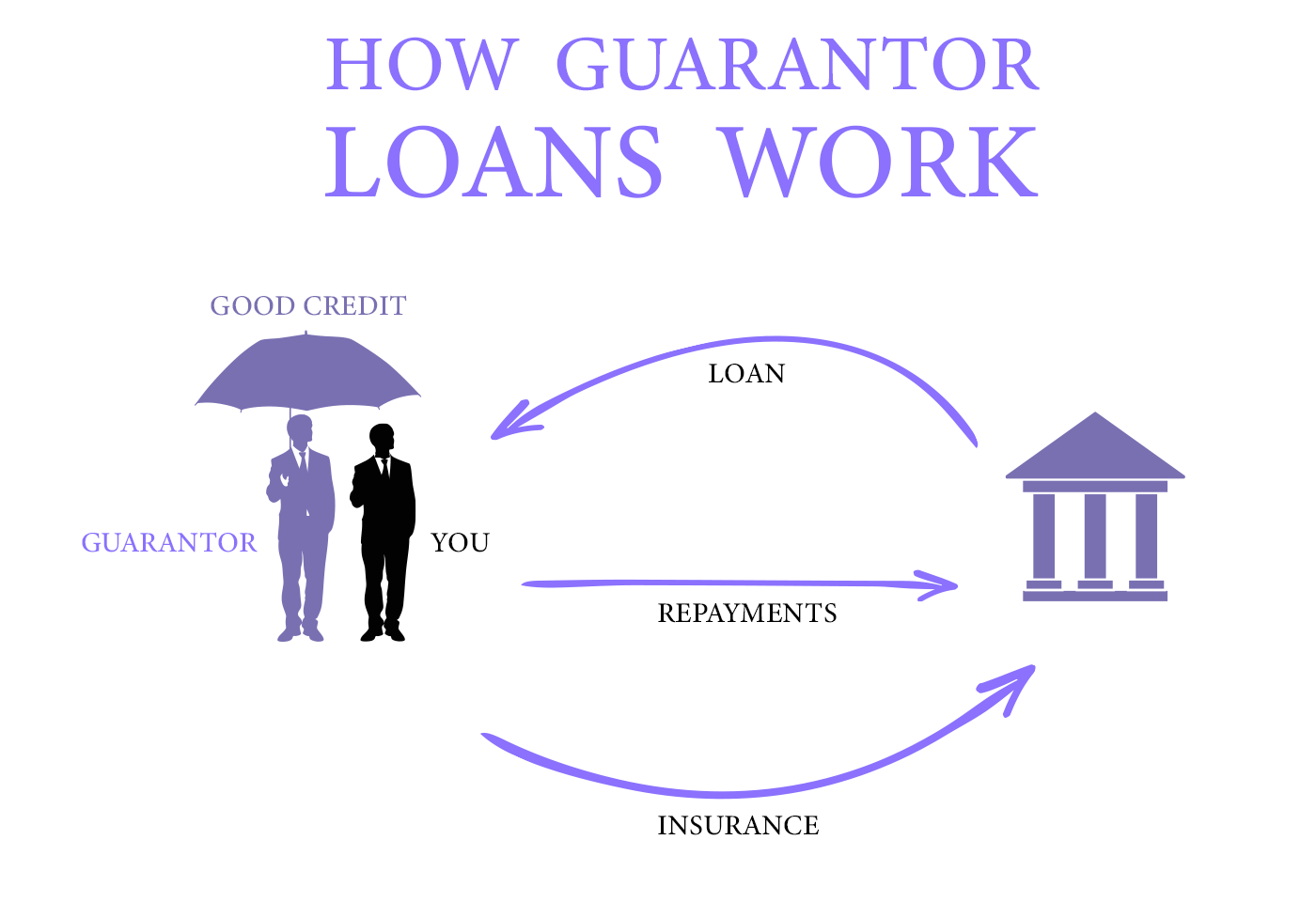

A Guarantor Loan

If you have bad repayment records, a guarantor loan may help you to borrow money if you have a relative with a strong credit history who would co-sign as a guarantee. However, if you default on a debt payment, a guarantor agrees to be responsible for the consequences. Another consideration is that guarantor loans are more expensive than other forms of quick financing since they often have higher interest rates, varying between 25% and 70%.

Bad Credit Loans

These are designed specifically for persons with weak or limited credit records. However, when compared to other forms of quick financing, the interest rates are quite expensive, typically over 49% on average. If you don't need money right now, it's a better idea to concentrate on repairing your credit first so you can get better offers in the future.

Credit Union Loans

Another handy alternative to payday advances is credit union financing. A credit union often applies no traditional check if you prove your ability to meet contractual obligations even if you have bad or no credit. When you get financing with a credit union, it can advise you to start a little regular savings plan, so you don't have to borrow again. Local unions are usually associated with a community, a profession, or a company. As a result, you must satisfy their requirements if you want to join.

Budgeting Loans

If you've been collecting certain benefits for at least six months, you could qualify for a government budgeting tool to meet your necessary household costs. These loans have no interest, so you simply have to pay back the amount you borrowed. Repayments are deducted from your benefits regularly over two years.