You may occasionally find yourself in a scenario where you require quick cash to pay unexpected costs but don't have time to wait. For example, a sudden automobile breakdown or a family sickness usually necessitates extra money that your budget cannot afford. Unfortunately, a typical bank will take significantly longer to qualify for financing, and if you have poor credit, your request will likely be rejected right away.

Quick cash may come in different forms, such as installment loans, prepaid debit cards, or pawn shop loans, but overnight payday advances remain one of the most popular options Americans turn to. You may expect the cash delivered into your bank account sooner than you think because the financing can be requested online, plus they require no traditional credit check.

Read on to discover more about the overnight payday loans, including who may qualify, the advantages, and handy alternatives. So, let's get things started.

Overnight Payday Loans Explained!

As the name implies, this type of financing is usually available overnight. You may wonder whether it's possible to get extra cash in a single day; the answer is yes. Most lenders understand that emergencies may require raising cash fast and cannot wait for a long application process or a delayed payout. As a result, the process is significantly faster than at a traditional bank or credit union.

Direct lenders operate 24 hours a day, seven days a week, so anybody who needs cash may apply beyond regular business hours, even after midnight. For example, if you fill out your credit request before 11 a.m, most direct lenders will likely provide cash on the same day. As a result, if you apply late at night, you may expect to get your funds the next day.

However, you should consider that weekends and national holidays are non-working days for most banks in the US; thus, funds may take some time to show in your account. So if it's Friday and you can't wait until the weekend, we suggest looking for direct payday cash providers who can give you cash right now.

Pros of Overnight Payday Loans

Even if you have bad or no credit, you may still qualify for overnight payday loans by filling out a credit request that only takes a few minutes. So whether you need $100 or a larger sum of $2500, or more, this form of payday loan provides you with the option of getting cash when you need it most. Here are a few additional advantages that overnight payday loans feature:

Easy to Access

The most significant benefit of payday loans is their accessibility. Many cash advance providers claim to provide financing within 24 hours and make a decision right away. Unlike traditional loans, which can take a long time to process, payday advances can be processed in as little as five minutes.

Fewer Qualifying Requirements

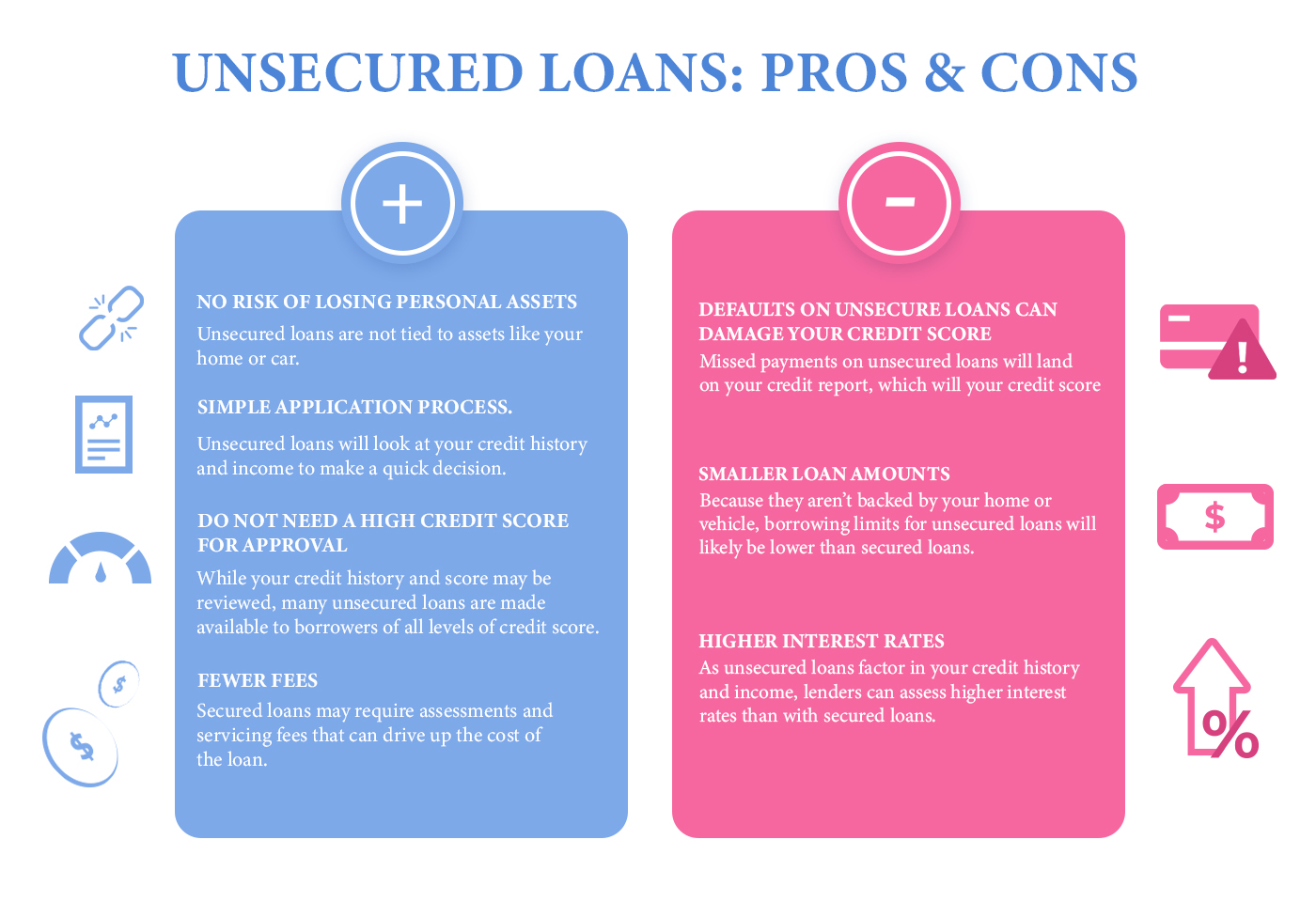

A Social Security Number, photo ID, evidence of income, a credit check, and verification of your credibility are the most common requirements set by traditional lenders. However, most quick cash tools have softer eligibility criteria than typical bank financing.

- To qualify for an overnight payday loan, you must first:

- Be 18 years old or older

- Hold a government-issued identification card or an SSN

- Have a steady source of income

- Hold an active bank account in good standing

While having fewer restrictions makes acquiring cash easier, bear in mind that the additional conditions imposed by banks and other lenders are generally designed to safeguard you.

Lenders don't Check Your Credit!

Most payday lenders don't check your credit to qualify for a loan. They don't pull your credit report, so there won't be any hard credit inquiry, harming your credit score. Remember that payday advances will not help you establish your credit; you'll need to move on to better financial tools, such as secured personal or debt consolidation loans.

No Collateral Required

Payday loans, unlike mortgages, title or car loans are not secured by personal property. This implies that if you fail on debt repayment, the lender won't be able to confiscate your property.

However, payday lenders frequently demand access to your bank account to set auto withdrawal which poses a specific form of risk. They can also take further steps, such as sending your debt to collectors or filing a lawsuit against you for unpaid debts.

Overnight Payday Loan Alternatives

Credit Unions

Credit unions are a great location to begin your search for a modest amount. It is now much simpler to join one, and members act as owners, allowing them to be more flexible with qualifying rules. Some local lenders may be ready to lend small amounts at low rates.

Cash Advances

Another alternative is to take out a credit card cash advance. Even though the interest rates are typically in the double digits, they are often far lower than those offered by payday lenders.

Check Alternatives

Before making a decision, shop around. Examine all accessible APRs and loan costs. Alternative lenders may charge high-interest rates, but they usually don't charge hefty rollover costs.

Self-defense is important. If you can't make a payment on time, notify creditors or loan servicers. They could be prepared to work with you and give you a payment plan to help avoid big price tag loans and skyrocketing charges.

Credit Counseling

Opt for non-profit organizations to get free or low-cost credit counseling. Then, go online to discover the best credit counseling firms, ask a local credit union, or get references from relatives.

Set Up Budget

When it comes to personal finances, it's essential to understand how much money you have coming in and how much you spend monthly. Next, consider cutting any costs that aren't necessary. For example, cutting cable costs is a fantastic way to lower your expenses. Look for a new supplier or switch to a less expensive plan. Consider that borrowing money at high-interest rates to cover normal monthly costs is a bad idea. If you can't afford to pay your rent without taking out a loan, look for a cheaper area to live.